Managing Child Support Debt During Bankruptcy Proceedings in Hawaii

In an ideal world, all parents could fully provide for their children. Unfortunately, this is not always feasible in reality. Many parents who want to provide financially for their children are unable to do so. Whether it’s because of a lack of vocational training, difficulty finding a high-paying job, slow economic growth in their area, overwhelming debt payments, or other reasons, being unable to provide for your children can be a heartbreaking situation.

When a parent cannot meet their mandated child support payments due to other debts, filing for bankruptcy may be an option. When a bankruptcy filer is obligated to make child support payments and intends to file bankruptcy, or if the co-parent from whom you receive child support is seeking debt relief through bankruptcy, it’s important to understand how bankruptcy will affect the situation.

In an ideal world, all parents could fully provide for their children. Unfortunately, this is not always feasible in reality. Many parents who want to provide financially for their children are unable to do so. Whether it’s because of a lack of vocational training, difficulty finding a high-paying job, slow economic growth in their area, overwhelming debt payments, or other reasons, being unable to provide for your children can be a heartbreaking situation.

When a parent cannot meet their mandated child support payments due to other debts, filing for bankruptcy may be an option. When a bankruptcy filer is obligated to make child support payments and intends to file bankruptcy, or if the co-parent from whom you receive child support is seeking debt relief through bankruptcy, it’s important to understand how bankruptcy will affect the situation.

Can Child Support Payments be Discharged in Bankruptcy?

Some individuals contact our bankruptcy lawyers hoping that bankruptcy will be a way to discharge their past due child support payments. Although both Chapter 7 and Chapter 13 bankruptcy will provide relief from some types of debt, it will not extinguish or discharge child support obligations made through mutual agreement or court order, including past due payments. However, relief from medical debt, credit card debt, and other financial obligations can make it easier for a parent to catch up on past-due child support. This means that filing for bankruptcy can be a good option for some individuals who need help with child support payments.

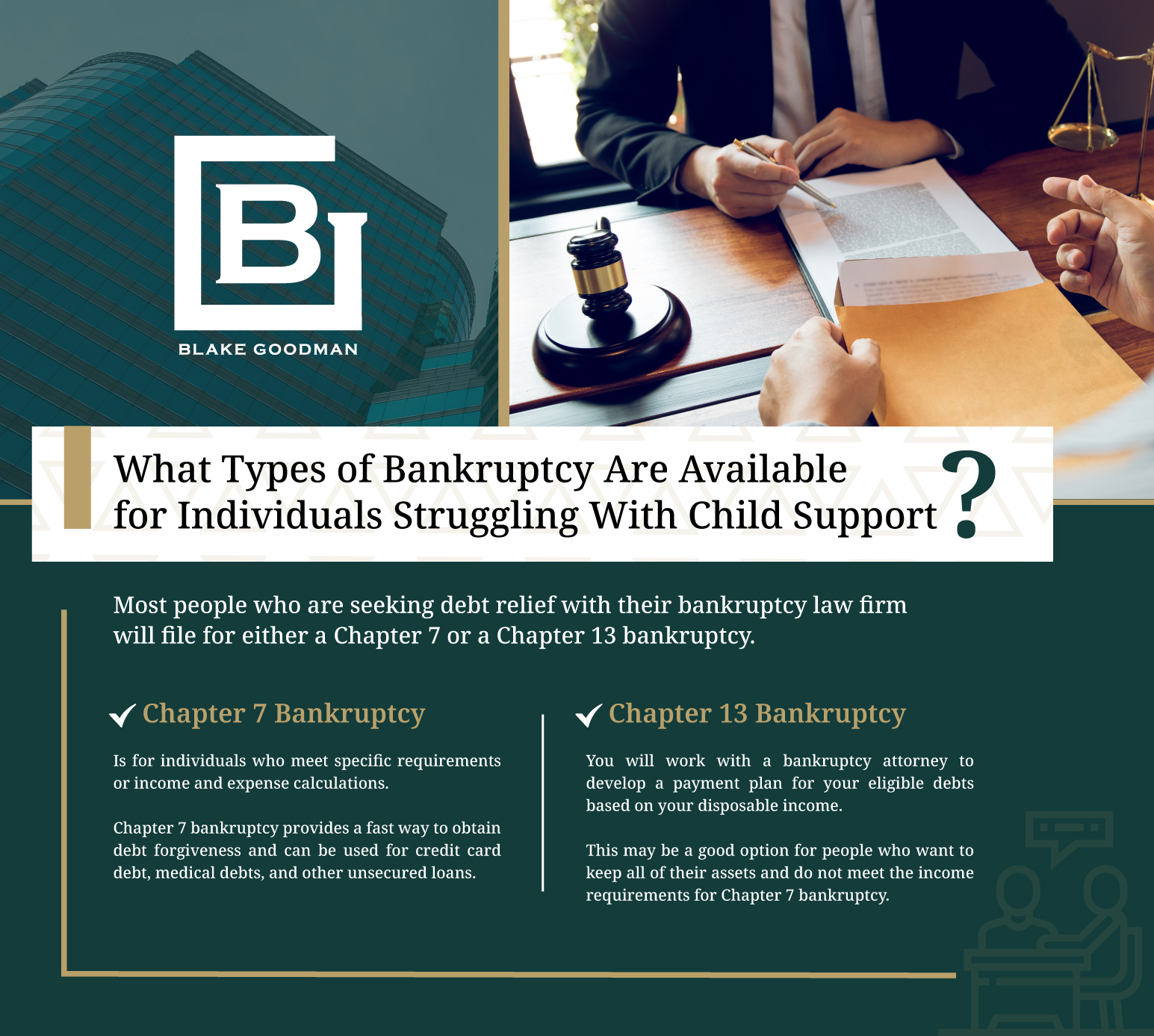

What Types of Bankruptcy are Available for Individuals Struggling with Child Support?

Most people who are seeking debt relief with their bankruptcy law firm will file for either a Chapter 7 or a Chapter 13 bankruptcy. These are two different approaches to bankruptcy that both ultimately result in a discharge of remaining debt. Chapter 7 bankruptcy is for individuals who meet specific requirements or income and expense calculations. Although many of your assets and property will be protected by state and federal bankruptcy guidelines, some assets may be liquidated and used to pay for your debts. The remaining balance on eligible debts will then be forgiven. Chapter 7 bankruptcy provides a fast way to obtain debt forgiveness and can be used for credit card debt, medical debts, and other unsecured loans. In a Chapter 13 bankruptcy, you will work with a bankruptcy attorney to develop a payment plan for your eligible debts based on your disposable income. Once approved, you will make monthly payments for the next 3-5 years. At the end of your repayment term, any remaining balances will be forgiven. Chapter 13 bankruptcy can be a good option for individuals who want to keep all of their assets and do not meet the income requirements for Chapter 7 bankruptcy.Does Bankruptcy Stop Child Support Payment Obligations?

Once you file for a Chapter 7 bankruptcy, an automatic stay will be put into place. This is a legal action that prevents creditors from pursuing claims against you and can bring a tremendous amount of relief if you’re facing pressure from debt collectors. However, this automatic stay does not apply to child support and a party who is seeking past due child support can still proceed even after you’ve filed for a Chapter 7 bankruptcy. Talk with your attorney about how to handle these types of situations. Any income that you earn after you’ve filed for Chapter 7 bankruptcy is not considered part of your estate, which means that it can be considered when the court is determining your child support obligations and in arrears payments.

If you’ve filed for a Chapter 13 bankruptcy, any income you earn is considered part of your estate. A party, such as a co-parent, who is seeking child support must request the court for relief from the automatic stay in order to pursue payments.

However, this automatic stay does not apply to child support and a party who is seeking past due child support can still proceed even after you’ve filed for a Chapter 7 bankruptcy. Talk with your attorney about how to handle these types of situations. Any income that you earn after you’ve filed for Chapter 7 bankruptcy is not considered part of your estate, which means that it can be considered when the court is determining your child support obligations and in arrears payments.

If you’ve filed for a Chapter 13 bankruptcy, any income you earn is considered part of your estate. A party, such as a co-parent, who is seeking child support must request the court for relief from the automatic stay in order to pursue payments.

Child Support is Considered a Priority Debt

Because state and federal court systems recognize the importance of providing for minor children, child support debt is considered a priority debt in both Chapter 7 and Chapter 13. Any child support debt that is owed will not be discharged in bankruptcy and the filer will be obligated to make overdue payments. Child support is prioritized over tax obligations and other debts. Individuals who file a Chapter 13 bankruptcy must pay off their past due child support in full as part of their repayment plan in order to receive a discharge from their other debts.Get Help with Past Due Child Support Payments

Are you feeling overwhelmed with past due child support payments and wondering how you will catch up as you also struggle with other debts? Reach out to Blake Goodman, P.C. We specialize in assisting individuals and families to find the debt relief they need. Whether through loan consolidation, filing for bankruptcy, or another option, we will work with you to develop a personalized approach to debt management. Contact us today to schedule your free, confidential consultation and to learn more about how we can help!

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.

Rate this Post

Loading...

Loading...