Chapter 7 vs. Chapter 13 Bankruptcy: Which is the Right Option For Medical Debt Discharge?

Costs for medical care can be significant. If you had a need for medical care and are now drowning in medical debt, you may wonder if there is even a way out. The problem can become even bigger if you start facing collections and wage garnishments. The good news is, when it comes to medical bills, bankruptcy can be a very helpful path forward.

Depending on your situation, you can file for Chapter 7 bankruptcy or Chapter 13 bankruptcy. In both situations, medical bills are unsecured debt and some or all of the debt can be discharged! However, not everyone should consider bankruptcy right away. Some may have alternative options and others may want to wait until all their bills have come through.

Talk with a bankruptcy lawyer to see if bankruptcy is a good option in your situation or if you should wait. The following article can help you understand your options and help determine when to get started:

Filing For Chapter 7 Bankruptcy On Medical Debt

Chapter 7 can be a helpful option for those that are overwhelmed with medical debt and want a way out without having to create a payment plan. Chapter 7 bankruptcy is sometimes called “liquidation” bankruptcy because in it, all your non-exempt assets will be liquidated to pay off secured loans and parts of some unsecured loans. Other unsecured loans will then be discharged, or wiped out entirely.

This is a great option for those that have a lot of medical debt that they are unable to pay. It provides immediate relief from collections agencies, lawsuits, and garnishments and leaves you with a clean slate at the end of the process. However, if your income is too high, you may not qualify for Chapter 7 bankruptcy. Your Chapter 7 Bankruptcy Lawyer can help determine if Chapter 7 is the right path for you.

Filing For Chapter 13 Bankruptcy On Medical Debt

If you don’t qualify for Chapter 7 bankruptcy, or you prefer to protect some assets, Chapter 13 bankruptcy might be a better option for your medical bill debt. In this situation, you will work with a trustee to agree on a 3-5 year repayment plan. All of your unsecured debt, including medical bills, will be consolidated.

You will work to pay off your debt during the 3-5 year plan. Once the 3-5 years is complete, any unsecured debt that you were unable to pay will be discharged. This includes medical debt. Chapter 13 bankruptcy is a helpful option for those that want to protect assets that they may have lost in Chapter 7 bankruptcy.

When Is The Right Time To File Bankruptcy For Medical Debt?

There are a few things to consider when you’re determining when is the right time to file for bankruptcy. First of all, your bankruptcy will only apply to any debts you have at the date of filing. This means that if you file for bankruptcy then accrue another medical bill later, you will be unable to add this medical bill to your bankruptcy plan.

Your bankruptcy lawyer can help you decide if you should file right away or wait. If you are still in the midst of a medical situation and expect more bills to show, you might consider waiting. If you are facing collections, lawsuits, wage garnishments, or threats of liens, you may consider filing as soon as possible. Your lawyer will help you come up with the best strategy.

Pros & Cons Of Filing Bankruptcy To Eliminate Medical Debt

When people think of bankruptcy, they may think of the cons to filing, but there are many pros as well. When it comes to overwhelming medical debt, bankruptcy can be a helpful option since medical bills are 100% dischargeable! Bankruptcy provides immediate relief from collections, wage garnishments, and more as well. If you are drowning in debt and want a fresh financial start, bankruptcy might be for you.

With anything, the cons do exist. Bankruptcy will affect your credit score, albeit for a time. Generally, Chapter 7 bankruptcy stays on your credit for 10 years and Chapter 13 bankruptcy for 7 years. However, medical debt collections are likely already harming your credit so filing for bankruptcy might stop the ongoing damage. Your bankruptcy will also be on public record, so anyone can see it, though most don’t check. Additionally, there is a legal process to filing for bankruptcy that will include paperwork, fees, and more.

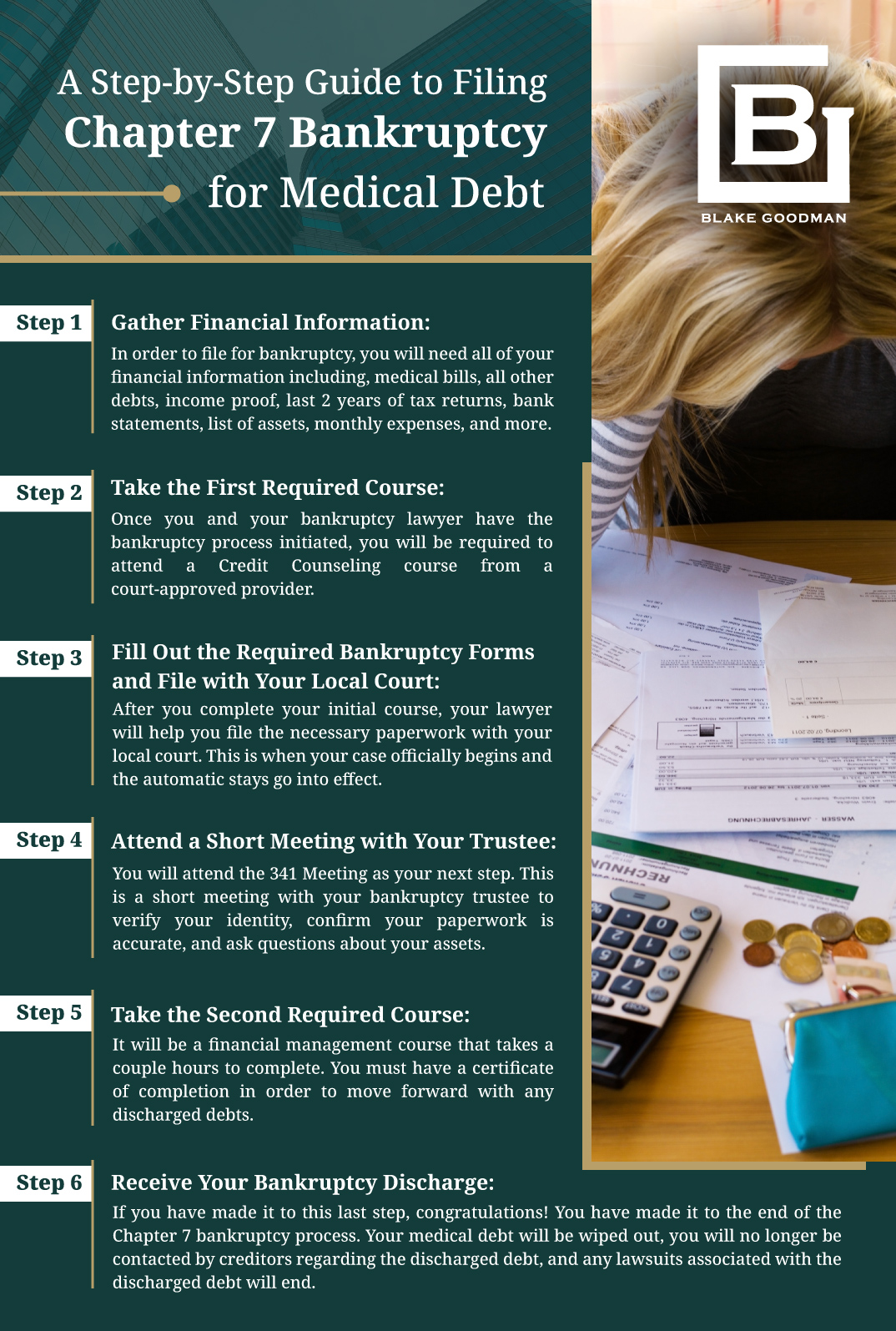

A Step-by-Step Guide To Filing Chapter 7 Bankruptcy For Medical Debt

- Step 1- Gather Financial Information: In order to file for bankruptcy, you will need all of your financial information including, medical bills, all other debts, income proof, last 2 years of tax returns, bank statements, list of assets, monthly expenses, and more.

- Step 2- Take the First Required Course: Once you and your bankruptcy lawyer have the bankruptcy process initiated, you will be required to attend a Credit Counseling course from a court-approved provider. This course is short and looks at your income, debts, and other options to make sure bankruptcy is the right path.

- Step 3- Fill Out the Required Bankruptcy Forms and File with Your Local Court: After you complete your initial course, your lawyer will help you file the necessary paperwork with your local court. This is when your case officially begins and the automatic stays go into effect.

- Step 4- Attend a Short Meeting with Your Trustee: You will attend the 341 Meeting as your next step. This is a short meeting with your bankruptcy trustee to verify your identity, confirm your paperwork is accurate, and ask questions about your assets.

- Step 5- Take the Second Required Course: The second course you will be required to take happens after you officially file for bankruptcy. It will be a financial management course that takes a couple hours to complete. You must have a certificate of completion in order to move forward with any discharged debts.

- Step 6- Receive Your Bankruptcy Discharge: If you have made it to this last step, congratulations! You have made it to the end of the Chapter 7 bankruptcy process. Your medical debt will be wiped out, you will no longer be contacted by creditors regarding the discharged debt, and any lawsuits associated with the discharged debt will end.

Payment Plans & Negotiating Medical Debt

In many cases, there are other options before you pursue bankruptcy for medical debt. Most large medical providers will offer hardship payment plans with no interest and no credit reporting as long as you keep up-to-date with payments. However, these plans often last for many years.

You can also negotiate with medical providers to reduce the amount of money you owe. This can be most successful if you can offer a lump sum and the bill is already in collections. If the bill is still with the medical provider, you may be able to request a reduction with them as well, though it is often not as successful as with a collections agency.

How Hospital Financial Programs Can Help You

There is often financial assistance available with hospitals, especially if you are lower income or experiencing hardship. Some options that hospitals might offer include:

- Partial discounts, often between 20-80%

- Full forgiveness of the bill

- Interest-free payment plans

Hospitals will consider your income as well as any hardship when determining how to handle your bills. Hardships can include:

- Medical hardship

- Loss of income

- Family size

- Ongoing health needs

- Catastrophic medical events

When You’re Judgement-Proof: Knowing When To Do Nothing

Some people may find that they are judgement-proof and doing nothing is their best course of action. Being “judgement-proof” doesn’t mean that you cannot be sued, it simply means that if sued, you have no assets that anyone can take, so no action can occur.

Your bankruptcy lawyer can help determine if you are judgement-proof. Some key things that make doing nothing make the most sense include:

- You’re judgement-proof now and in the future: If your living situation is unlikely to change, you have fixed income, no plans to buy property, and no expected income increase, so nothing for creditors to take now or in the future.

- Debt is coming close to its statute of limitations: If the deadline for creditors to sue you on your debt is coming close, you may consider letting it run. However, if you do so, be sure to consult with your attorney and do not make any payments.

- All of your assets are exempt: If you’re being sued, creditors can take any assets that are non-exempt. If these don’t exist, there is nothing creditors can take.

Why You Should Hire a Bankruptcy Lawyer For Medical Debt

When you’re facing overwhelming medical debt, it can be wise to consult with a bankruptcy attorney. Doing so protects you and helps you avoid any mistakes that might disallow you from discharging debts.

Your lawyer will help you find everyone that you owe, including debts that have not been billed yet. They will handle communications with collectors, financing companies, and any other creditors. They will also help you utilize as many exemptions as possible so you can keep as many of your assets as possible. Overall, hiring a lawyer means a smoother process, less risk, and protection of your rights and assets.

Hire Our Trusted Hawaii Bankruptcy Lawyers To Help Decide How To Handle Overwhelming Medical Debt

Don’t face your medical debt alone. Our Honolulu bankruptcy lawyers at Blake Goodman have the experience and knowledge necessary to help you move towards financial freedom. We will evaluate your case and will help you decide which bankruptcy chapter is right for you. Or maybe you want to consider an alternative, but collections agencies are breathing down your neck. We have you covered.

Ensure your assets are protected and you get the most out of your bankruptcy by contacting us today!

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

220 Imi Kala St. #203BWailuku, HI 96793

Phone: (808) 515-2037

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.