Detailed Guide To Bankruptcy Fraud: Types, Legal Penalties & Prevention

For some people or businesses, there may come a time in life where they are unable to pay their debts and will have to consider filing for bankruptcy. Filing for bankruptcy should never be taken lightly and it is wise to consult with a bankruptcy attorney to determine if it is the best course of action.

Unfortunately, there are individuals who take advantage of the system and commit bankruptcy fraud. This type of fraud is serious and can lead to harsh consequences. This is why it is so important to work with a knowledgeable professional to ensure all the steps are completed properly.

Understanding Bankruptcy Fraud: Definitions & Implications

There are many types of bankruptcy fraud and it is helpful to understand what they are and the consequences associated. This knowledge helps prevent fraud as well as helps protect the bankruptcy system so those in need have access.

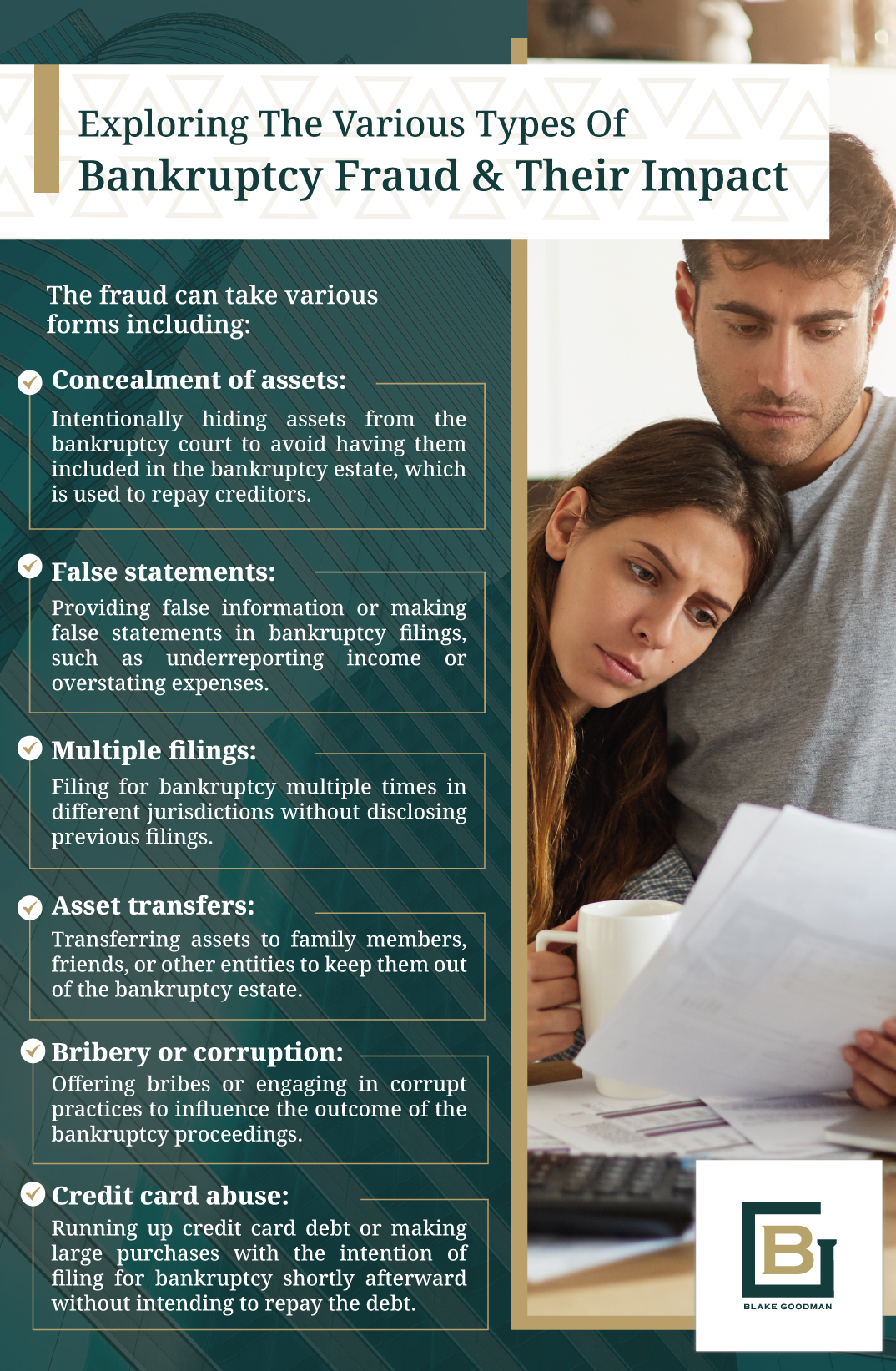

Exploring The Various Types Of Bankruptcy Fraud & Their Impact

A bankruptcy attorney will tell you that bankruptcy fraud is a serious offense that can result in criminal charges, including fines and imprisonment. The fraud can take various forms including:

- Concealment of assets: Intentionally hiding assets from the bankruptcy court to avoid having them included in the bankruptcy estate, which is used to repay creditors.

- False statements: Providing false information or making false statements in bankruptcy filings, such as underreporting income or overstating expenses.

- Multiple filings: Filing for bankruptcy multiple times in different jurisdictions without disclosing previous filings.

- Asset transfers: Transferring assets to family members, friends, or other entities to keep them out of the bankruptcy estate.

- Bribery or corruption: Offering bribes or engaging in corrupt practices to influence the outcome of the bankruptcy proceedings.

- Credit card abuse: Running up credit card debt or making large purchases with the intention of filing for bankruptcy shortly afterward without intending to repay the debt.

It’s important to have a clear understanding of the types of bankruptcy fraud to promote fair and transparent bankruptcy proceedings, protect the interest of creditors, and to uphold the integrity of the legal system.

The Serious Consequences Of Committing Bankruptcy Fraud

Bankruptcy fraud is serious and can lead to anything from minor penalties to harsh criminal charges and even imprisonment. When it comes to some of the lesser penalties, individuals may be required to pay a fine, repay certain debt, or have their bankruptcy discharge denied.

Criminal charges, however, can lead to months or even years in prison as well as fines. In addition to penalties given by the court, those found of bankruptcy fraud may end up with a poor credit score that is hard to remove.

Overall, this type of fraud is taken very seriously by the legal system and individuals convicted can face serious penalties. It is recommended to hire a bankruptcy attorney to ensure every aspect of your filing is accurate and above board.

Effective Strategies To Prevent Bankruptcy Fraud

Secondly, when working with your attorney and the courts, it is essential to be honest and disclose everything you have including assets, income, debts, and any other financial information.

Along with honesty, it is essential to keep accurate records of all of your financial transactions. These transactions include:

- Income Records

- Proof of Expenses

- Debt Records

- Asset Records

- Financial Statements

- Tax Returns

- Communication with Creditors

The Importance Of Hiring a Bankruptcy Attorney For Legal Guidance

Bankruptcy attorneys are crucial when it comes to filing for bankruptcy and preventing fraud. The bankruptcy process can be detailed and confusing and an attorney will help provide legal expertise, identify potential issues, ensure compliance with legal requirements, and advocate for their client’s interests throughout the process.

When considering bankruptcy, an attorney’s guidance and representation are invaluable in safeguarding against fraudulent behavior and ensuring a fair and lawful resolution of financial difficulties.

Trust Our Bankruptcy Attorneys For Top-Quality Consultation & Representation

Rely on our Honolulu bankruptcy attorneys when you’re in the midst of filing for bankruptcy. With a deep understanding of hawaii bankruptcy laws and regulations, our team is dedicated to guiding you through every step of the process with clarity and integrity.

Contact us today and get peace of mind as you navigate the complexities of your bankruptcy proceedings.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

220 Imi Kala St. #203BWailuku, HI 96793

Phone: (808) 515-2037

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.