The Effects Of Individual Bankruptcy On Joint Property In Hawaiian Law

Filing for individual bankruptcy is a big decision that can affect not only your life and assets but also the lives and assets of those you co-own assets with. This can be a concern especially if you jointly own Hawaiian real estate property.

If you are a co-owner of property, whether your bankruptcy can affect your properties depends on the property laws of your state, who you own property with, whether your property is exempt, and which Chapter of bankruptcy you file for.

Before filing for bankruptcy, it’s crucial to consult with a Hawaii bankruptcy attorney who can help you understand how Hawaii’s specific exemptions and bankruptcy law apply to your situation. They will assist in maximizing the protection of your property and guide you through the bankruptcy process.

Filing for individual bankruptcy is a big decision that can affect not only your life and assets but also the lives and assets of those you co-own assets with. This can be a concern especially if you jointly own Hawaiian real estate property.

If you are a co-owner of property, whether your bankruptcy can affect your properties depends on the property laws of your state, who you own property with, whether your property is exempt, and which Chapter of bankruptcy you file for.

Before filing for bankruptcy, it’s crucial to consult with a Hawaii bankruptcy attorney who can help you understand how Hawaii’s specific exemptions and bankruptcy law apply to your situation. They will assist in maximizing the protection of your property and guide you through the bankruptcy process.

What Happens to Your Property When You File for Bankruptcy?

When you file for bankruptcy in Hawaii, your property becomes part of the bankruptcy estate. The treatment of your property depends on the type of bankruptcy you file, either Chapter 7 or Chapter 13, as well as the exemptions available to you under Hawaiian law. In Chapter 7 bankruptcy, a trustee is appointed to liquidate non-exempt assets to repay creditors. However, individuals are allowed to keep certain properties exempt from the bankruptcy estate, up to a certain value. Filing for Chapter 7 triggers an automatic stay, which temporarily halts actions, including foreclosure and repossession. In Chapter 13 bankruptcy, you propose a repayment plan to repay all or a portion of your debts over a three to five-year period. Your property is not liquidated, but the plan must be feasible and approved by the court. You can typically keep all of your property, including non-exempt assets, as long as your proposed repayment plan meets the requirements of the bankruptcy court.Joint Property & Bankruptcy In Hawaii

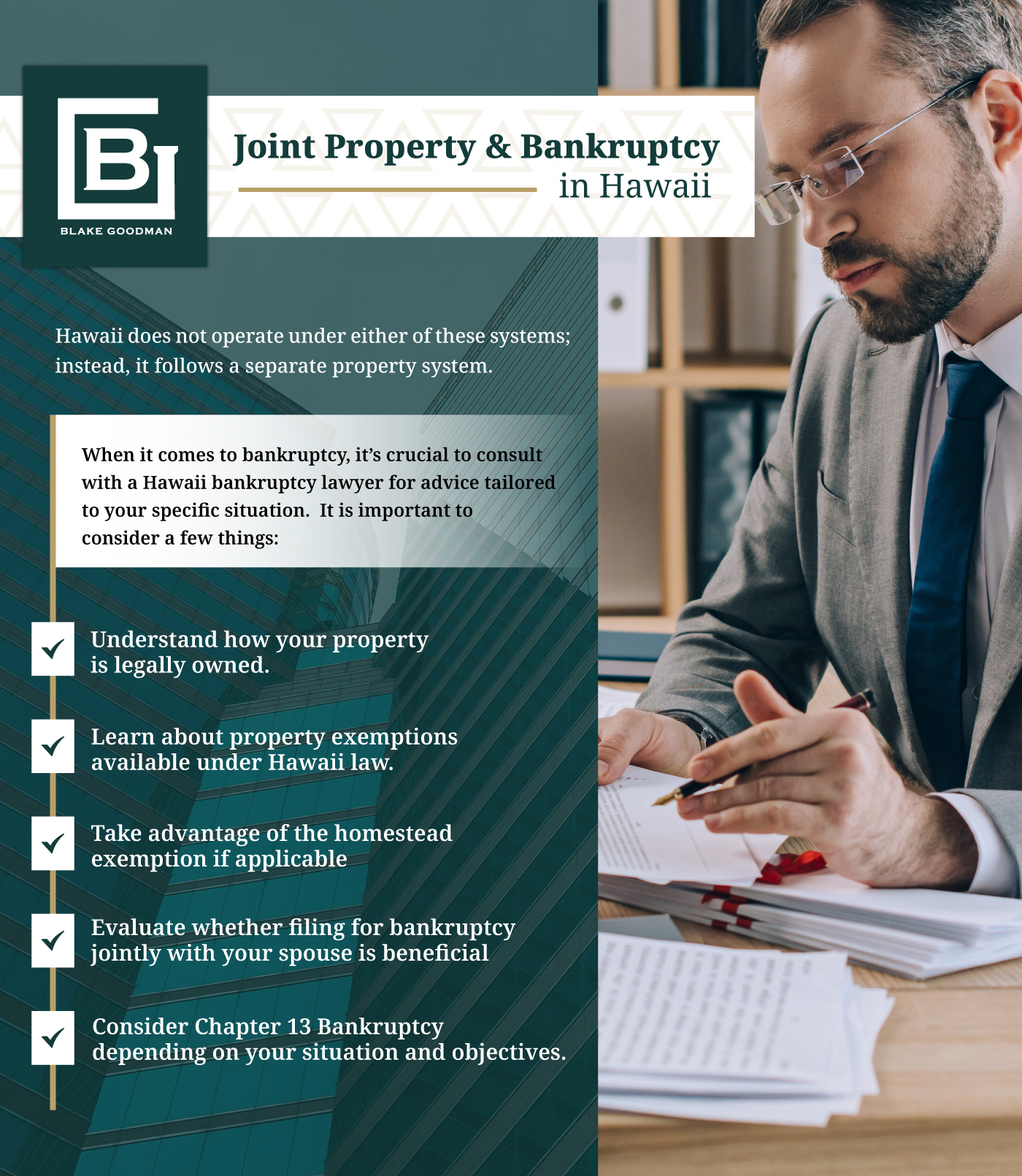

Hawaii does not operate under either of these systems; instead, it follows a separate property system. Hawaii law recognizes a concept called “tenancy by the entirety” for married couples. In a tenancy by the entirety, the property is owned by the married couple as a single legal entity rather than as one or two individuals. When it comes to bankruptcy, it’s crucial to consult with a bankruptcy lawyer for advice tailored to your specific situation. It is important to consider a few things:- Understand how your property is legally owned. If it’s held as “tenancy by the entirety”, this may provide certain protections in bankruptcy.

- Learn about property exemptions available under Hawaii law. Some exemptions protect certain types and amounts of property.

- Take advantage of the homestead exemption if applicable which protects a certain amount of equity in your primary residence.

- Evaluate whether filing for bankruptcy jointly with your spouse is beneficial as it may positively impact exemptions.

- Consider Chapter 13 bankruptcy, depending on your situation and goals, which involves a repayment plan and offers more flexibility in retaining assets.

How Joint Property Is Dealt With During Bankruptcy In the United States

Two different property states govern how your joint property is dealt with during individual bankruptcy and they vary by state. The states are divided into Common Law Property States and Community Property States. Community Property States declare marital property as generally owned equally by both spouses, and each spouse has an equal interest in the assets acquired during the marriage, even if they are not on a title. In this case, all of the joint property will become property of the bankruptcy estate if not under any exemptions. Common law property states operate under a legal system that recognizes individual property ownership based on court decisions and legal titles rather than marriage. This means that property acquired during marriage is considered the sole property of the individual who acquired it unless there is evidence of joint ownership.Joint Ownership Advantage: How Hawaiian Exemptions Can Protect Your Property

Exemptions play an important role in your bankruptcy. In Chapter 7 bankruptcy, exemptions can protect some or all of your property from being liquidated. In Chapter 13, the exemptions reduce the amount you will have to pay back to creditors.

bankruptcy lawyers can help you determine what exemptions your property qualifies for. There are several key exemptions available under Hawaiian law, including the homestead exemption, but it is crucial to pay attention to which ones apply to you. This is especially important if you have joint property as the exemption could protect you and your co-owner!

Exemptions play an important role in your bankruptcy. In Chapter 7 bankruptcy, exemptions can protect some or all of your property from being liquidated. In Chapter 13, the exemptions reduce the amount you will have to pay back to creditors.

bankruptcy lawyers can help you determine what exemptions your property qualifies for. There are several key exemptions available under Hawaiian law, including the homestead exemption, but it is crucial to pay attention to which ones apply to you. This is especially important if you have joint property as the exemption could protect you and your co-owner!

Get In Touch With Our Hawaii Bankruptcy Attorneys For Your Bankruptcy Needs!

When you co-own a property in Hawaii and need an attorney to determine how your bankruptcy will affect the property and your co-owner, look no further than Blake Goodman’s bankruptcy attorneys! With years of dedicated service, we are committed to being by your side, ensuring confidence throughout the process. Get the peace of mind you deserve during your bankruptcy. Reach out to us and get a pressure-free consultation today!

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.

Rate this Post

Loading...

Loading...