Assessing Your Bankruptcy Options For Debt Relief While Unemployed In Hawaii

If you’re unemployed and feeling overwhelmed with debt, you might be wondering how you are going to make your payments and what options you might have to relieve financial pressure. Many people are relieved to learn that you don’t need to be employed in order to file for bankruptcy. However, not having an income from a job may affect which type of bankruptcy you are eligible to file.Reasons To Seek Debt Relief Through Chapter 7 Bankruptcy While Unemployed

Chapter 7 bankruptcy is a fast approach to bankruptcy that is typically resolved within four months. In order to qualify, you’ll need to pass the “means test.” This means you must either make less than the median income in your state, or you’ll need to ask your Chapter 7 bankruptcy lawyer to guide you through a series of income and expense calculations that are based on your family size. Most people who are unemployed will pass the means test based on their income alone.

With a Chapter 7 bankruptcy, eligible debts, which include credit cards, past due rent, utility bills, and medical bills can generally be eliminated, or discharged, within four months. Federal and state bankruptcy laws establish protected property known as “exempt property” that is protected from seizure by the bankruptcy trustee. This generally includes your primary home and vehicle, personal property, and some of your bank accounts. The nonexempt property will be sold by the bankruptcy trustee to help pay your creditors. However, it’s common for individuals filing for Chapter 7 bankruptcy to have very few eligible assets to sell because they have already sold any secondary vehicles, property, and goods that they owned in order to make their loan payments prior to filing for bankruptcy.

Chapter 7 bankruptcy is a fast approach to bankruptcy that is typically resolved within four months. In order to qualify, you’ll need to pass the “means test.” This means you must either make less than the median income in your state, or you’ll need to ask your Chapter 7 bankruptcy lawyer to guide you through a series of income and expense calculations that are based on your family size. Most people who are unemployed will pass the means test based on their income alone.

With a Chapter 7 bankruptcy, eligible debts, which include credit cards, past due rent, utility bills, and medical bills can generally be eliminated, or discharged, within four months. Federal and state bankruptcy laws establish protected property known as “exempt property” that is protected from seizure by the bankruptcy trustee. This generally includes your primary home and vehicle, personal property, and some of your bank accounts. The nonexempt property will be sold by the bankruptcy trustee to help pay your creditors. However, it’s common for individuals filing for Chapter 7 bankruptcy to have very few eligible assets to sell because they have already sold any secondary vehicles, property, and goods that they owned in order to make their loan payments prior to filing for bankruptcy.

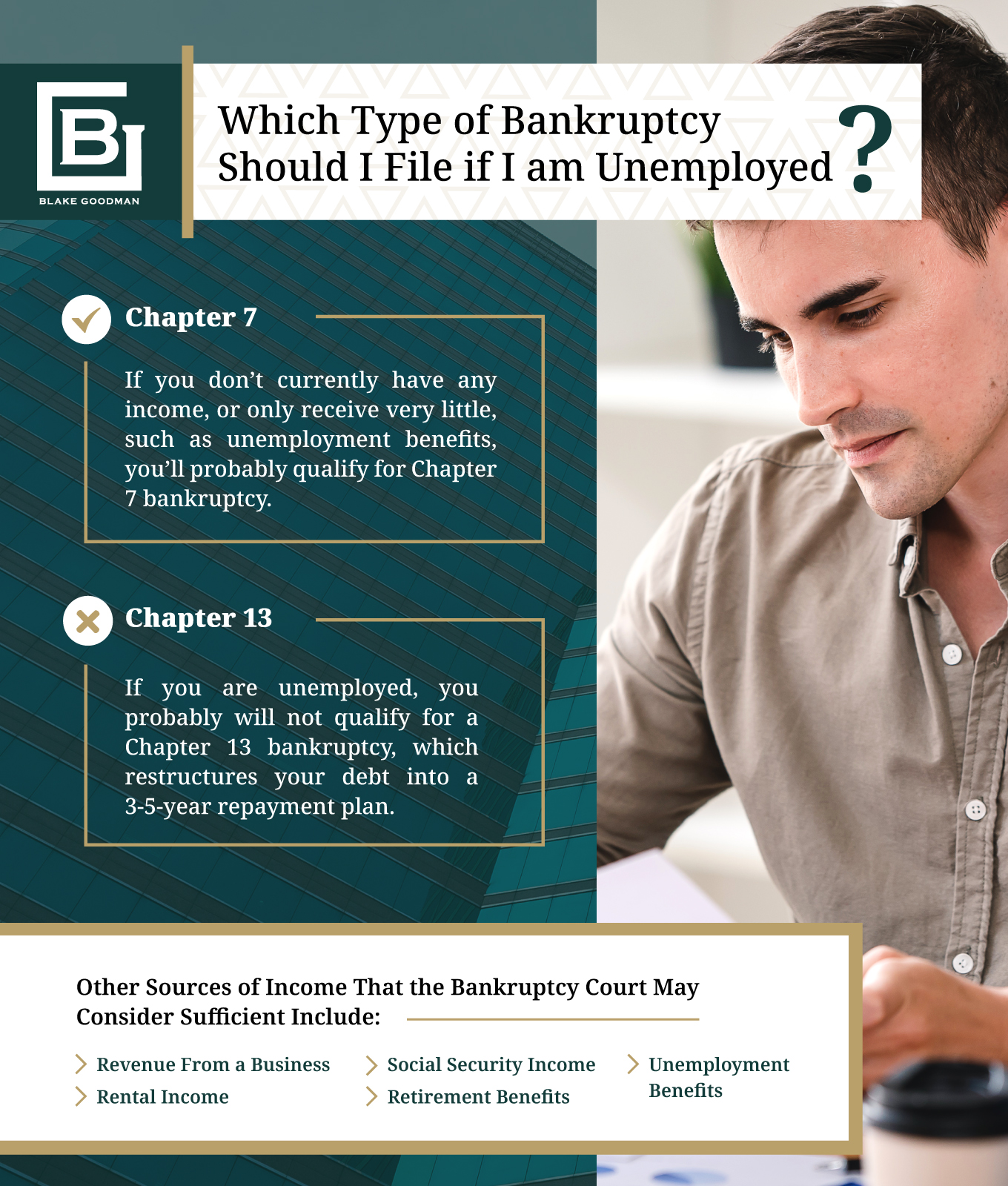

Which Type of Bankruptcy Should I File if I am Unemployed?

If you don’t currently have any income, or only receive very little, such as unemployment benefits, you’ll probably qualify for Chapter 7 bankruptcy. This approach utilizes the sale of some of your eligible assets to pay off your loans, the balance of which will be discharged about four months after filing once your bankruptcy petition is complete. If you are unemployed, you probably will not qualify for a Chapter 13 bankruptcy, which restructures your debt into a 3-5-year repayment plan. In order to successfully receive a Chapter 13 bankruptcy, you’ll need to have a significant source of income. There are some circumstances in which you can have enough income to obtain a Chapter 13 bankruptcy while unemployed, but it’s not very common. Learn more about which type of bankruptcy might be right for you when you consult with a bankruptcy attorney near you.The Means Test & Qualifying for Bankruptcy: Timing Your Chapter 7 Filing After Job Loss

If you’ve recently lost a high-paying job, you may not immediately pass the means test because the test includes any income that you’ve received in the last six months. Even if you are not currently working, your income may initially be too high and you won’t qualify for Chapter 7 bankruptcy. The solution is to wait a few months. If you’re still unemployed after a few months, your average income will decrease and you are likely to pass. Consult with your zero-down bankruptcy lawyer to learn more about timing your bankruptcy filing and passing the means test. If you file for bankruptcy and your petition is denied, there may be a waiting period before you can file again.Can I File for Chapter 13 Bankruptcy if I am Unemployed?

Many people want to avoid losing their assets and want to file for Chapter 13 bankruptcy. Unfortunately, this can be difficult to accomplish while unemployed because you’ll need a source of income in order to repay your creditors.

If you qualify, your Chapter 13 bankruptcy lawyer can help you draft a proposed repayment plan for the next 3-5 years in which your disposable income will be paid to your creditors. Debtors can use a Chapter 13 bankruptcy to catch up on their mortgage payments, eliminate a second mortgage, pay off vehicle loans, manage student loan debt, and more. This can be beneficial for many individuals but only works if you have a source of income.

However, you don’t necessarily have to be working in order to qualify for a Chapter 13 bankruptcy. Other sources of income that the bankruptcy court may consider sufficient include:

Many people want to avoid losing their assets and want to file for Chapter 13 bankruptcy. Unfortunately, this can be difficult to accomplish while unemployed because you’ll need a source of income in order to repay your creditors.

If you qualify, your Chapter 13 bankruptcy lawyer can help you draft a proposed repayment plan for the next 3-5 years in which your disposable income will be paid to your creditors. Debtors can use a Chapter 13 bankruptcy to catch up on their mortgage payments, eliminate a second mortgage, pay off vehicle loans, manage student loan debt, and more. This can be beneficial for many individuals but only works if you have a source of income.

However, you don’t necessarily have to be working in order to qualify for a Chapter 13 bankruptcy. Other sources of income that the bankruptcy court may consider sufficient include:

- Revenue from a business

- Rental income

- Social security income

- Unemployment benefits

- Retirement benefits

Get in Touch with Blake Goodman, P.C. for Expert Help in Filing for Bankruptcy in Hawaii

Blake Goodman, P.C. can assist you in showing the bankruptcy court that you have a steady income, which may help you get approval for your Chapter 13 bankruptcy application. Whether you qualify for a Chapter 7 or Chapter 13 bankruptcy, the good news is that there are financial options if you’re facing overwhelming debts. Contact us today. This article is provided courtesy of Arizona Bankruptcy Lawyers, an experienced bankruptcy law firm that provides affordable solutions for individuals and families seeking financial relief.

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.

Rate this Post

Loading...

Loading...