What Are The Usual Wait Times Between Bankruptcy Filings?

If you are thinking about filing for bankruptcy or have filed for bankruptcy in the past, you may be wondering how soon you can file again in Hawaii. The exact amount of time you’ll need to wait will depend on a variety of factors, such as which type of bankruptcy you filed and whether your bankruptcy was completed. Hawaii bankruptcy law is complex, but your Hawaii bankruptcy attorney can provide a personalized answer that applies to your situation. Here are some basic guidelines to help you understand how long you may need to wait to file for bankruptcy again.How Often Can I File For Bankruptcy In Hawaii?

Hawaii residents can file for bankruptcy as many times as they need to but will need to wait a specific amount of time between filings. For most people, it’s best to work to rebuild your credit after bankruptcy rather than filing for bankruptcy again, but a repeat bankruptcy can become the best option if debt becomes unmanageable or if you face unexpected circumstances.

How long you’ll need to wait between filings will depend on which type of bankruptcy was filed and whether your case was completed successfully or dismissed. It’s important to realize that filing repeat bankruptcies back to back could cause you to lose the benefits of an automatic stay order. An automatic stay is a court order that is put in place when you file for bankruptcy and prevents your creditors from continuing their collection efforts. This is just one reason why it’s essential to ask your bankruptcy law firm for advice and to follow the required wait times between filings.

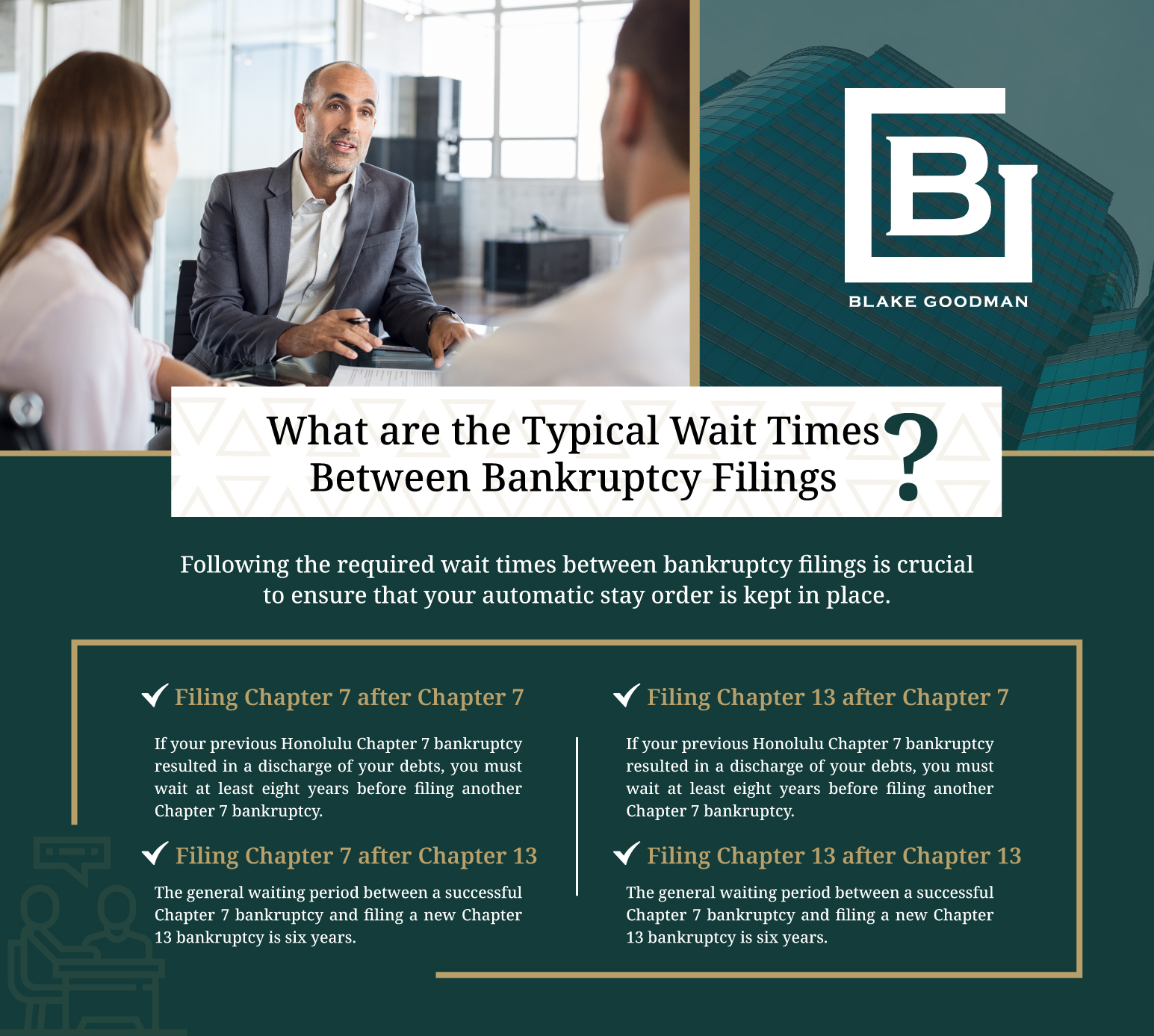

What Are The Typical Wait Times Between Bankruptcy Filings?

Following the required wait times between bankruptcy filings is crucial to ensure that your automatic stay order is kept in place. The time frame begins when you filed your previous bankruptcy, not when you received a discharge. If you filed a bankruptcy that did not result in a discharge, you may only need to wait 180 days before you file again.Filing Chapter 7 After Chapter 7

If your previous Chapter 7 bankruptcy resulted in a discharge of your debts, you must wait at least eight years before filing another Chapter 7 bankruptcy.Filing Chapter 7 After Chapter 13

The general waiting period between a successful Chapter 7 bankruptcy and filing a new Chapter 13 bankruptcy is six years. However, if you paid off your unsecured debts in full during the initial Chapter 13 bankruptcy, or if you paid at least 70% and worked hard in good faith to repay what you owed, you may not be required to wait the full six years. Consult with your bankruptcy lawyer to learn more about these requirements.Filing Chapter 13 After Chapter 7

If you’ve previously received a Chapter 7 discharge, you’ll need to wait at least four years before you can file a Chapter 7 case. Alternatively, you can potentially avoid this waiting period if you file a Chapter 13 bankruptcy immediately after Chapter 7 and submit a payment plan to repay debt that wasn’t cleared during your Chapter 7 case. This is sometimes known as a “Chapter 20” bankruptcy.Filing Chapter 13 After Chapter 13

This scenario has the shortest waiting period of just two years. However, it rarely happens in reality because most Chapter 13 debt restructure bankruptcies take 3-5 years to fully repay. If you’re experiencing extreme financial hardship, your initial Chapter 13 bankruptcy may be discharged early and you may have circumstances that prompt you to file for Chapter 13 bankruptcy again.

What If My Previous Bankruptcy Filing Was Unsuccessful?

Not all bankruptcy filings or cases result in a discharge of debt, which can significantly shorten your timeline for filing again. How long you must wait will depend on why the case did not become discharged.- The court dismissed your case: If you did not appear in court, did not respond to court orders, or voluntarily dismissed your case, you can typically file again in 180 days unless the court says otherwise.

- The court denied your discharge: There are many reasons why the court may not approve your bankruptcy, which can include lack of documentation, hidden assets, or perjury. If your case was dismissed because you were dishonest, you may be able to file for bankruptcy again, but the debts from your previous case will probably not be discharged.

How Can I Successfully File a Repeat Bankruptcy?

Filing for bankruptcy can be stressful. It’s essential to create a plan to help your case move smoothly through the court system. Your first step should always be to consult with an experienced bankruptcy attorney who can help you understand your legal options, assist you in determining which type of bankruptcy is best for you, and time the bankruptcy filing to your best advantage. In some cases, filing one type of bankruptcy will be more advantageous than another. You may also have other financial options besides bankruptcy that your attorney can guide you through. Be sure to meet or exceed the wait time between filings to avoid a dismissal that could have been avoided.

Consult With Hawaii’s Leading Bankruptcy Attorney For a Free Consultation

Are you ready to move toward financial freedom and looking for a way out of overwhelming debt? Schedule your free consultation with Blake Goodman, PC, Attorney today. Our experienced bankruptcy attorneys are ready to listen to your story, walk you through your legal options, and provide trusted legal advice and representation throughout the bankruptcy process. We can get your bankruptcy started for just $100! Contact our trusted firm today to get started.

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.

Rate this Post

Loading...

Loading...