Do Hawaii Bankruptcy Laws Affect Your Filing Frequency?

The decision to file for bankruptcy is a major one that comes with various stipulations and timelines. One common question is how often you can file for bankruptcy, a topic that necessitates professional insight. Guidance from a seasoned Honolulu bankruptcy attorney can shed light on this complex matter, helping you navigate your options and legal rights.

At Blake Goodman, P.C., we’ve helped many clients understand Hawaii’s specific bankruptcy regulations and timelines. Our goal is to empower you to make informed decisions about your financial future, explaining the rules around bankruptcy filing frequency and what they mean for you.

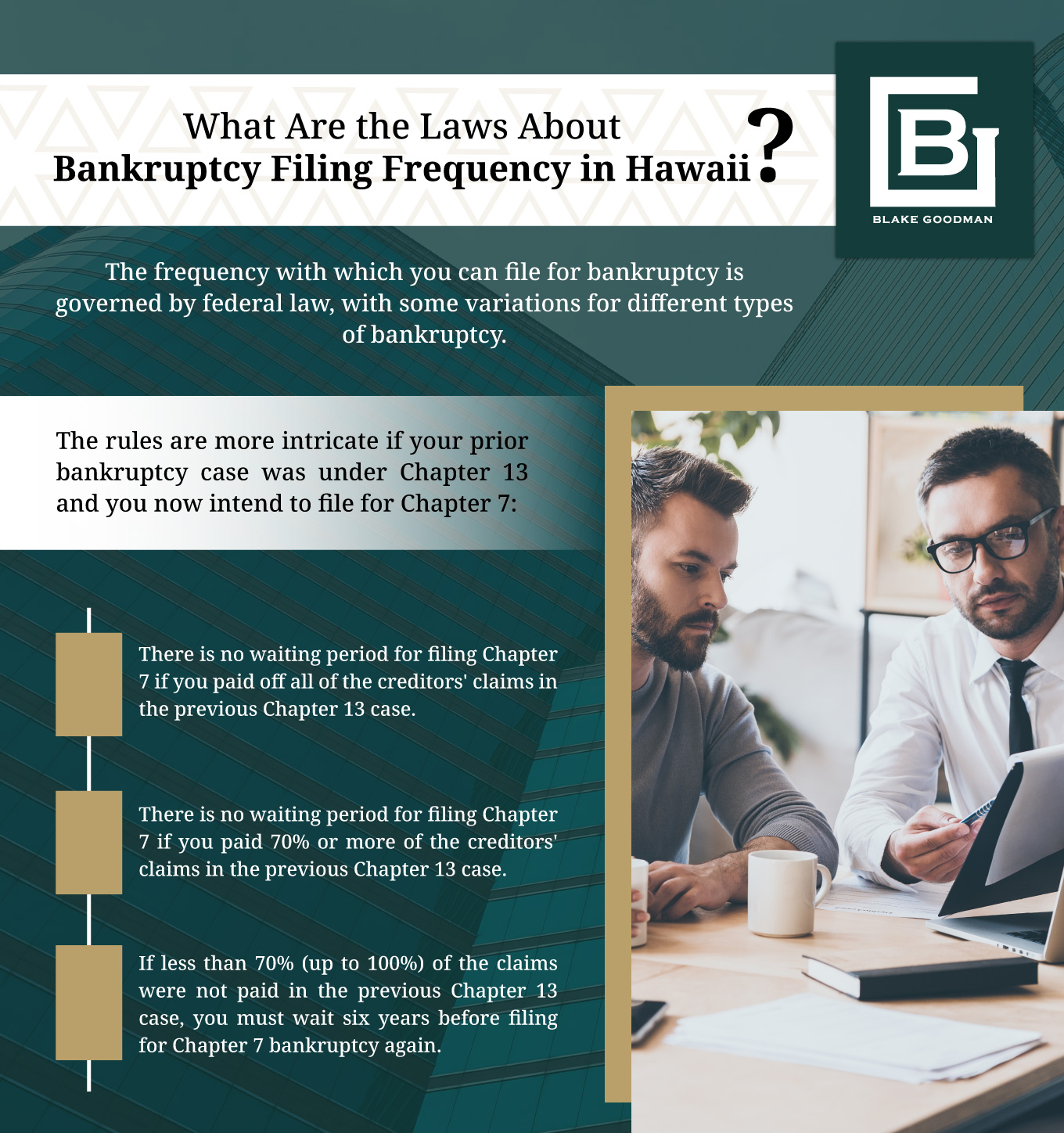

What Are the Laws About Bankruptcy Filing Frequency in Hawaii?

The frequency with which you can file for bankruptcy is governed by federal law, with some variations for different types of bankruptcy. For Chapter 7 bankruptcy, the most common type, you must wait eight years from your previous filing date before you can file again. This waiting period exists to discourage bankruptcy misuse and gives individuals an opportunity to restore their financial health.

The frequency with which you can file for bankruptcy is governed by federal law, with some variations for different types of bankruptcy. For Chapter 7 bankruptcy, the most common type, you must wait eight years from your previous filing date before you can file again. This waiting period exists to discourage bankruptcy misuse and gives individuals an opportunity to restore their financial health.

The rules are more intricate if your prior bankruptcy case was under Chapter 13 and you now intend to file for Chapter 7:

- There is no waiting period for filing Chapter 7 if you paid off all of the creditors’ claims in the previous Chapter 13 case.

- There is no waiting period for filing Chapter 7 if you paid 70% or more of the creditors’ claims in the previous Chapter 13 case, and your Chapter 13 repayment plan was considered a “good faith” proposal, reflecting your best effort to repay. “Best effort” means you must have used all of your disposable income (income left after paying for living expenses and mandatory payments) to repay the creditors.

- If less than 70% (up to 100%) of the claims were not paid in the previous Chapter 13 case, you must wait six years before filing for Chapter 7 bankruptcy again.

Chapter 13 bankruptcy, often referred to as a wage earner’s plan, allows a debtor to repay some or all of their debts through a court-approved plan that spans three to five years.

If you had previously filed for Chapter 7 bankruptcy and now wish to file for Chapter 13 bankruptcy, you would generally need to wait at least four years from the date of your Chapter 7 filing. However, if your previous bankruptcy case was under Chapter 13, and you want to file for another Chapter 13 case, the waiting period typically reduces to two years from the date of your previous bankruptcy filing.

How Does the Frequency of Bankruptcy Filings Affect Your Financial Health?

While bankruptcy can offer a lifeline to those drowning in debt, it’s not without its consequences. Repeated filings can have a serious impact on your credit score, which in turn affects your ability to secure credit, housing, and sometimes even employment.

Bankruptcy filings remain on your credit report for up to ten years, depending on the type of bankruptcy. But a history of bankruptcy doesn’t mean your financial health is permanently compromised. With disciplined financial practices and advice from a bankruptcy lawyer, you can rebuild your credit over time and set a course toward financial recovery.

If you had previously filed for Chapter 7 bankruptcy and are now considering filing for Chapter 13 bankruptcy, you would generally have to wait for at least four years from the date of your Chapter 7 filing. On the other hand, if your prior bankruptcy case was a Chapter 13, and you intend to file for another Chapter 13 case, the waiting period typically decreases to two years from the date of your previous bankruptcy filing.

What Restrictions Apply to Regular Bankruptcy Filings?

While bankruptcy is designed to provide relief for individuals struggling with unmanageable debt, it’s not intended for repeated use without consequences. Several restrictions apply to regular bankruptcy filings:

- Each bankruptcy filing leaves a lasting mark on your credit report, staying on record for seven to ten years depending on the type of bankruptcy.

- Multiple bankruptcy filings can significantly lower your credit score, hindering your ability to secure future credit, housing, and sometimes even employment.

- Bankruptcy filings are public records, which means repeated filings can impact your personal reputation.

- If you’re seen to be abusing the bankruptcy system through excessive filings, the court may dismiss your case or bar you from filing in the future.

- Regular filings can also limit the types of bankruptcy relief available to you.

Why Is Consulting a Honolulu Bankruptcy Attorney Crucial?

Bankruptcy is a complicated legal process that requires a comprehensive understanding of both federal and state laws. From determining your eligibility to file to understanding the specific timelines involved, a bankruptcy law firm plays an essential role. They can provide the legal guidance necessary to navigate these complex waters and help you make decisions that are in your best interest.

Get in Touch with a Trusted Honolulu Bankruptcy Attorney Today

At Blake Goodman, P.C., our team of experienced attorneys is here to help. We specialize in guiding clients through the complexities of bankruptcy, ensuring you’re fully informed and confident about your path forward.

Don’t navigate this journey alone. Contact us today for a free consultation. Let our experienced Honolulu bankruptcy attorneys guide you toward financial stability and peace of mind.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

220 Imi Kala St. #203BWailuku, HI 96793

Phone: (808) 515-2037

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.