Impact Of Bankruptcy On Future Home Loans: Chapter 7 vs. Chapter 13 Insights

The impact largely depends on the specific type of bankruptcy—Chapter 7 or Chapter 13—each carrying different implications for one’s ability to secure a mortgage in the future. This crucial distinction underscores the need for clear understanding and strategic planning for those looking to regain financial stability and pursue homeownership.

The impact largely depends on the specific type of bankruptcy—Chapter 7 or Chapter 13—each carrying different implications for one’s ability to secure a mortgage in the future. This crucial distinction underscores the need for clear understanding and strategic planning for those looking to regain financial stability and pursue homeownership.

In addressing these concerns, the expertise of Hawaii bankruptcy attorneys becomes essential. Their knowledge of how different bankruptcy filings interact with mortgage approval processes can offer invaluable guidance, helping individuals navigate the complexities of rebuilding credit and meeting lenders’ requirements for a post-bankruptcy mortgage.

Securing a Mortgage Post-Bankruptcy: Essential Considerations & Steps

A bankruptcy lowers your credit score, but you can still qualify for a mortgage if you can provide lenders with assurance you’ll repay.

Here are some things to consider:

- Bankruptcy Status: Major lenders and mortgage investors require that the bankruptcy be either discharged or dismissed before application. Many loan types also require a waiting period before you can apply.

- Credit Score: Bankruptcy usually means a big drop in your credit score and a big negative point on your credit report. With bad credit, you’ll struggle to qualify for any new loans.

- Time: Your candidacy will depend on how long it takes to build up your credit score. There’s no set time, but it’s a good idea to wait until your credit rating is back to a reasonable score.

- Type Of Bankruptcy: Your mortgage candidacy will depend on what type of bankruptcy you’ve filed.

- Lender: How your lender handles bankruptcy and mortgages.

Path To Mortgage Approval Post-Bankruptcy: Strategies For Financial Recovery

In Hawaii, securing a mortgage post-bankruptcy is feasible, provided you navigate through a mandatory waiting period and meet other essential eligibility criteria. The journey towards mortgage approval becomes smoother as time passes since your bankruptcy discharge, especially when accompanied by significant improvements in your credit history.

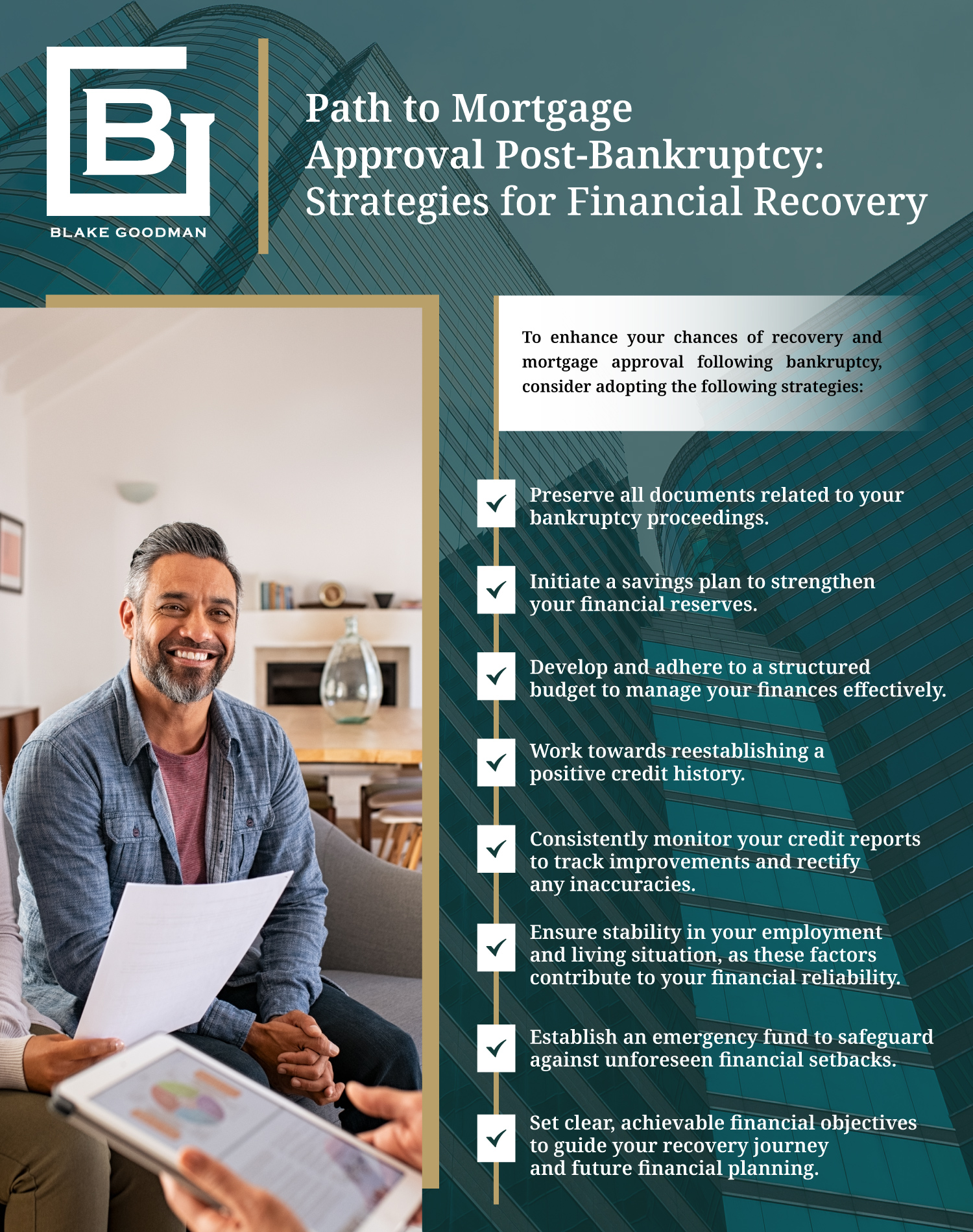

To enhance your chances of recovery and mortgage approval following bankruptcy, consider adopting the following strategies:

- Preserve all documents related to your bankruptcy proceedings.

- Initiate a savings plan to strengthen your financial reserves.

- Develop and adhere to a structured budget to manage your finances effectively.

- Work towards reestablishing a positive credit history.

- Consistently monitor your credit reports to track improvements and rectify any inaccuracies.

- Ensure stability in your employment and living situation, as these factors contribute to your financial reliability.

- Establish an emergency fund to safeguard against unforeseen financial setbacks.

- Set clear, achievable financial objectives to guide your recovery journey and future financial planning.

Understanding Chapter 7 Bankruptcy: Implications For Your Mortgage & Property

When it comes to mortgages and how Chapter 7 bankruptcy affects them, Engaging the services of a bankruptcy attorney in Hawaii can be an invaluable resource. Once you file for Chapter 7 bankruptcy, an automatic stay goes into effect which temporarily halts collections actions, including foreclosure proceedings.

Mortgages are considered secured debts so you are typically able to keep your mortgage if you continue making mortgage payments and it falls under exemptions. If you have property that cannot be protected by exemptions, the bankruptcy trustee may sell the property to repay creditors, including the mortgage lender.

In Chapter 7 bankruptcy, you may no longer be legally obligated to repay the loan. However, if the mortgage company still has a lien on your property, they have the right to repossess. It is in your best interest, if possible, to continue paying your mortgage payments.

Maximizing Your Chapter 7 Exemptions: Protecting Your Home In Hawaii

The good news is, that if your home equity is within the allowable exemption limit, you may be able to keep your home even in Chapter 7 bankruptcy. It’s important to consult with a Hawaii bankruptcy attorney to understand the specific exemptions available to you and the best way to go about your bankruptcy.

Chapter 13 Bankruptcy Explained: Protecting & Managing Your Mortgage

Similar to Chapter 7 bankruptcy, Chapter 13 bankruptcy triggers an automatic stay, temporarily halting foreclosure on your home. One of the primary benefits of Chapter 13 is that it allows debtors to catch up on past-due mortgage payments throughout the 3-5-year repayment plan. This is especially helpful if you are facing foreclosure.

In some cases, Chapter 13 bankruptcy may provide the opportunity to eliminate unsecured second mortgages or home equity lines of credit. The Hawaii bankruptcy court may also have the authority to modify the interest rates on secured debts like mortgages, under the repayment plan, making mortgages more affordable to the debtor.

Successful completion of the Chapter 13 repayment plan results in the discharge of remaining eligible debts, including unsecured debts. Mortgage debt is not discharged, however, but the debtor emerges from bankruptcy with a current and manageable mortgage status.

Partner With Our Trusted Hawaii Bankruptcy Attorneys For Peace Of Mind

At Blake Goodman PC, our seasoned Hawaii bankruptcy attorneys specialize in demystifying the complexities of bankruptcy law, offering personalized, expert guidance tailored to your circumstances. Our commitment is to provide you with a clear path through the financial turmoil, ensuring a strategy that aligns with your specific needs and goals.

Embrace the expertise, support, and compassionate approach of our dedicated team. Contact us today for a complimentary consultation, and take the first step towards regaining control of your financial future with confidence.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

220 Imi Kala St. #203BWailuku, HI 96793

Phone: (808) 515-2037

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.