The Impact of Bankruptcy on Co-Signers & Guarantors

If you have debts with co-signers or guarantors, your bankruptcy petition could affect them and their responsibility for the loan. Many of these cases become complicated, so be sure to consult with your bankruptcy law office for guidance. Your attorney may also be able to help you find ways to prevent creditors from pursuing your co-signers if you file for bankruptcy.

If you have debts with co-signers or guarantors, your bankruptcy petition could affect them and their responsibility for the loan. Many of these cases become complicated, so be sure to consult with your bankruptcy law office for guidance. Your attorney may also be able to help you find ways to prevent creditors from pursuing your co-signers if you file for bankruptcy.

Common Scenarios Where Creditors Require a Co-Signer

Lenders who are unsure about your ability to repay a loan will frequently require someone else who has more income, more assets, less debt, or better credit to be responsible for the loan with you. Common reasons why a bank or lender might require a co-signer include:- You don’t have much credit history

- You have a low credit score

- You filed for bankruptcy in the 7-10 years

- You don’t have collateral for the loan

- You want to borrow more than you can repay at your current income

- Your debt-to-income ratio is too high

- You’re borrowing money for your business

- You’re a first-time renter

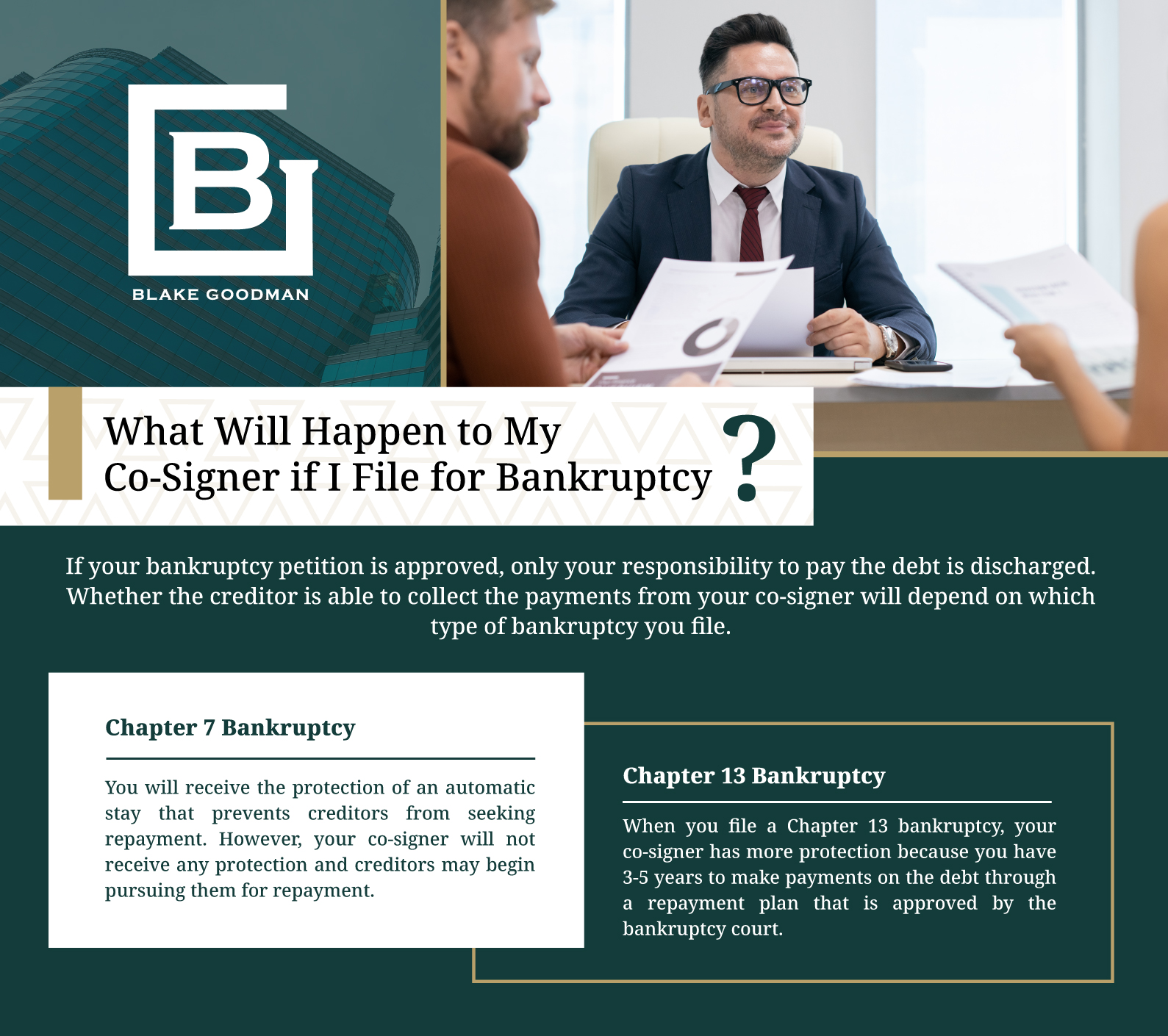

What Will Happen to My Co-Signer if I File for Bankruptcy?

If your bankruptcy petition is approved, only your responsibility to pay the debt is discharged. This means your co-signer is still obligated to repay. Whether the creditor is able to collect the payments from your co-signer will depend on which type of bankruptcy you file.Chapter 7 Bankruptcy

When you file for a Chapter 7 bankruptcy, you will receive protection from an automatic stay that prevents creditors from seeking repayment. However, your co-signer will not receive any protection and creditors may begin to pursue them for repayment.Chapter 13 Bankruptcy

When you file a Chapter 13 bankruptcy, your co-signer has more protection because you have 3-5 years to make payments on the debt through a repayment plan that is approved by the bankruptcy court. An automatic stay is put in place when you file Chapter 13 bankruptcy as well, but your creditors can ask the court to lift the automatic stay if:- Your co-signer received the benefits of your claim

- Your proposed Chapter 13 repayment plan does not pay back the loan in full

- The creditor will lose money if the stay remains in place

- Your case is dismissed by the bankruptcy court or is converted to a Chapter 7 bankruptcy

How Can I Protect My Co-Signer if I File Bankruptcy?

Talk with your bankruptcy lawyer about the multiple ways that you can protect your co-signer from collection efforts if you file for Chapter 7 bankruptcy. Your options include:Reaffirming the debt: Before you can receive a discharge in Chapter 7 bankruptcy, you can reaffirm some specific debts (usually secured debts, such as vehicle loans, mortgages, and loans for technology for furniture). In this case, you give up the benefit of discharge and make yourself personally liable for the financial obligation. This is usually recommended only when you need the physical item or want to protect your co-signer.

- Paying off the debt: Once you’ve received a discharge, you are no longer obligated to make payments on your debt. However, you can still make payments on the loan and voluntarily pay them off. Talk with your bankruptcy lawyer about how to do this. If you pay off debts before filing, your bankruptcy trustee may undo the transaction because it appears to favor one creditor more than another.

How Will My Bankruptcy Filing Affect a Co-Signer’s Credit?

Filing for bankruptcy only directly affects your credit and will not make direct changes to your co-signer’s credit. However, if your co-signer is unable to make the payments on the loan or ends up filing for bankruptcy themselves, their credit will then be adversely affected.Navigating Bankruptcy with Expert Guidance in Hawaii

Filing for bankruptcy can be complicated, emotional, and overwhelming, especially when you’re already dealing with pressure from collections. That’s where consulting with an experienced bankruptcy lawyer in Hawaii can help. At Blake Goodman, P.C., we use our experience and comprehensive knowledge of financial law to help our clients achieve financial freedom and a fresh start. Whether debt consolidation, filing for bankruptcy, or another alternative is the best option for you, we are ready to guide you through the entire process with respect and professionalism. Our team is prepared to help you through every step of the process, no matter how complicated the situation or how much debt you owe. Contact our office today to schedule your free, confidential consultation with one of our trusted bankruptcy attorneys. There is hope!

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.

Rate this Post

Loading...

Loading...

Reaffirming the debt:

Reaffirming the debt: