Bankruptcy & Government Debts: Distinguishing the Dischargeable from the Non-Dischargeable

Individuals and families struggling with debt may consider filing for bankruptcy as an option to find financial freedom and relief from creditors. If you owe money to a local, state, or federal government, such as fines, overdue taxes, penalties, or another debt, you may be wondering if you can find relief by filing for bankruptcy.

Generally speaking, you will not be able to get rid of debts owed to the government in bankruptcy. However, there are a few exceptions. It’s a good idea to consult with a trusted bankruptcy attorney who can review the details of your situation and provide personalized advice. There may be other ways to deal with the overwhelming debt other than filing for bankruptcy. For some individuals, finding relief from credit card debt, medical bills, and other loans in bankruptcy can give them the financial flexibility they need to make payments on debt owed to the government.

Individuals and families struggling with debt may consider filing for bankruptcy as an option to find financial freedom and relief from creditors. If you owe money to a local, state, or federal government, such as fines, overdue taxes, penalties, or another debt, you may be wondering if you can find relief by filing for bankruptcy.

Generally speaking, you will not be able to get rid of debts owed to the government in bankruptcy. However, there are a few exceptions. It’s a good idea to consult with a trusted bankruptcy attorney who can review the details of your situation and provide personalized advice. There may be other ways to deal with the overwhelming debt other than filing for bankruptcy. For some individuals, finding relief from credit card debt, medical bills, and other loans in bankruptcy can give them the financial flexibility they need to make payments on debt owed to the government.

What Types of Debt Can Be Owed to the Government?

There are many different types of debts that are payable to local, state, or federal governments. One of the most common types of government debt is overdue taxes, which frequently include fines and penalties as well as the actual tax amount. Government fines or penalties may be assessed as a consequence of breaking the law. These can be enforced at the city, county, state, or federal level. Individuals may be ordered to pay fines as a result of receiving a speeding ticket or traffic violation, as part of the consequences for a criminal conviction, violations of government agency regulations, or for another violation of the law.Can Fines and Penalties be Discharged in Bankruptcy?

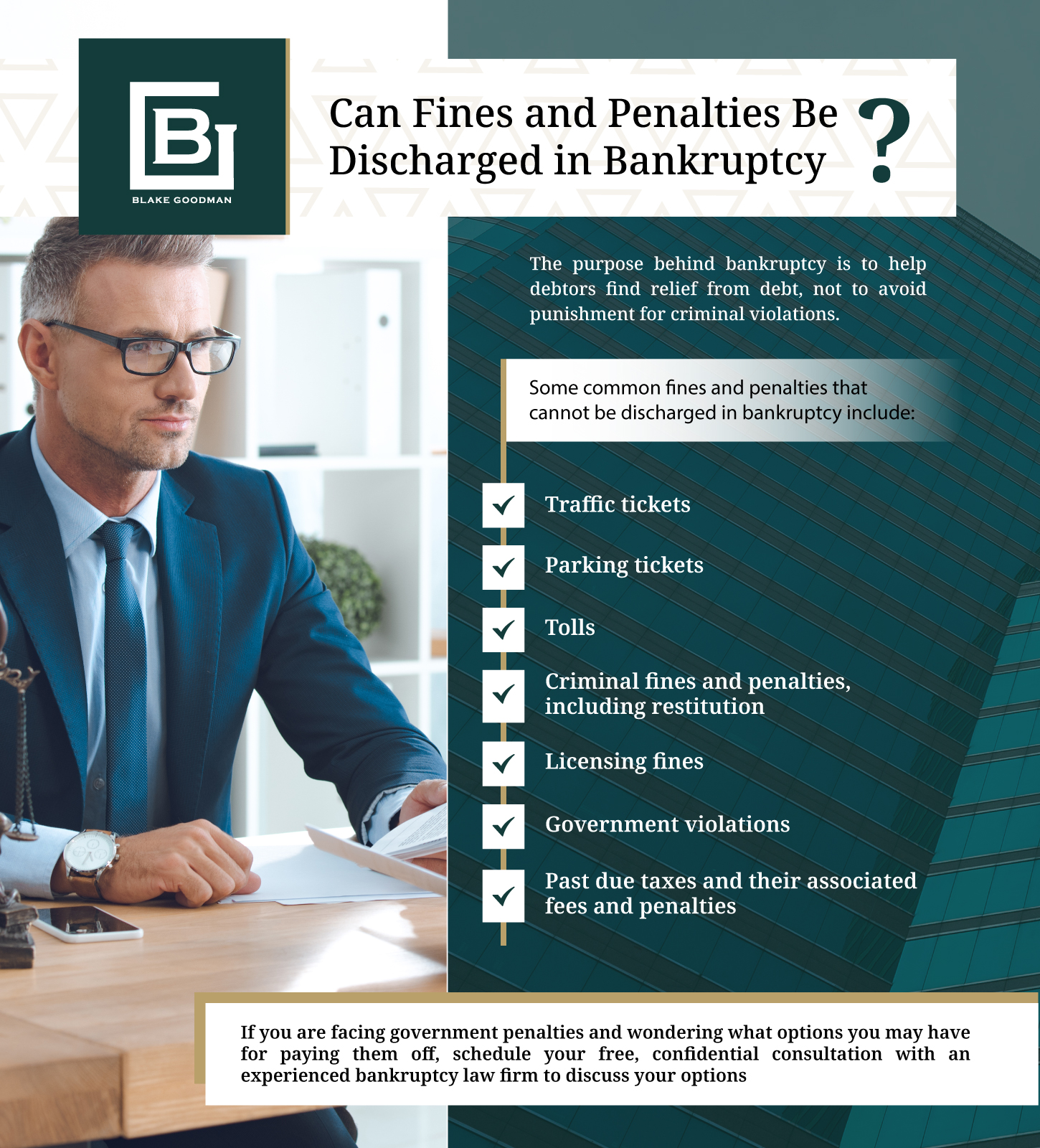

The purpose behind bankruptcy is to help debtors find relief from debt, not to avoid punishment for criminal violations. Because fines and penalties are forms of punishment and written into the law, they are not dischargeable in bankruptcy. Some common fines and penalties that cannot be discharged in bankruptcy include:- Traffic tickets

- Parking tickets

- Tolls

- Criminal fines and penalties, including restitution

- Licensing fines

- Government violations, such as violations of the U.S. Environmental Protection Agency (EPA) or Occupational Safety and Health Administration (OSHA) regulations

- Past due taxes and their associated fees and penalties at the local, state, or federal level

When Can Money Owed to the Government be Discharged in Bankruptcy?

There are a few rare cases where money that you owe to a government agency is not technically a fine or penalty. Government fines and penalties that are intended as punishments, such as for criminal violations, cannot be discharged in Chapter 7 bankruptcy or Chapter 13 bankruptcy. However, you may be able to discharge debt that is owed to the government if you accidentally damage or destroy government property. This could include rear-ending a government vehicle at a stop sign or another form of unintentional damage to a government asset. Because repair or replacement of damaged property is not technically punishment and not enforceable by the law, you may be able to discharge that debt in bankruptcy, as long as it was an accident. Talk with your bankruptcy law firm for more information.What is the Difference Between Fines & Property Damage Bills?

It may be difficult to determine whether your bill from a government agency is a fine or a request for reimbursement for property damage. In some cases, it may be both. Talk with your bankruptcy attorney and take a close look at the paperwork that you receive. Bills for fines and penalties will likely include the authorizing law. Your attorney can help you determine whether the fine that you received is within the law’s guidelines.How Can an Attorney Help Me with Government Debt?

Owing money to the government can feel overwhelming, especially if you are on a tight budget and not sure how you will pay. Although most government fines and penalties cannot be discharged in bankruptcy, you may have other options, including debt consolidation and negotiation, to help you move forward. Some individuals may find that bankruptcy gives them relief from other types of debt, enabling them to have the cash flow to pay their debts to the government. Reach out to a trusted debt settlement lawyer today to learn more!

Owing money to the government can feel overwhelming, especially if you are on a tight budget and not sure how you will pay. Although most government fines and penalties cannot be discharged in bankruptcy, you may have other options, including debt consolidation and negotiation, to help you move forward. Some individuals may find that bankruptcy gives them relief from other types of debt, enabling them to have the cash flow to pay their debts to the government. Reach out to a trusted debt settlement lawyer today to learn more!

Looking for Guidance on Government Debt from a Local Bankruptcy Attorney?

If you owe the government taxes, fines, or penalties, and are wondering how you will find the means to pay, schedule your free appointment with Hawaii’s leading bankruptcy lawyer. Blake Goodman, P.C. has decades of experience assisting individuals in finding solutions for overwhelming debt. Our team will work with you to understand your situation, develop a personalized strategy, and guide you through your options, which may include filing for bankruptcy or finding another means to approach your debt. Contact us today to get started!

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.

Rate this Post

Loading...

Loading...