Why Filing Bankruptcy Triggers Immediate Relief From Creditor Harassment

It can be a difficult choice to pursue bankruptcy. Filing can affect many aspects of life, from impeding privacy to losing assets to having to rebuild a credit score. However, if you’re considering bankruptcy, you’re likely being contacted by creditors and collections agencies demanding money and taking action on your debt. You might be in a no-win situation, stressed out by the constant communication, and weight of your hefty debt.

In a situation like this, bankruptcy might be your best option. One of the significant benefits of filing for bankruptcy is the automatic stay which goes into effect as soon as you file. This automatic stay will halt any harassment you are getting from money collectors. The following is everything you should know about an automatic stay:

How The Automatic Stay Protects You After Filing Bankruptcy

The automatic stay exists under Section 362 of the United States Bankruptcy Code, affecting all states including Hawaii as well as all chapters of bankruptcy. Whether you’re an independent debtor or a business, your bankruptcy lawyer can help you file for bankruptcy, which begins the automatic stay immediately.

The automatic stay exists under Section 362 of the United States Bankruptcy Code, affecting all states including Hawaii as well as all chapters of bankruptcy. Whether you’re an independent debtor or a business, your bankruptcy lawyer can help you file for bankruptcy, which begins the automatic stay immediately.

The automatic stay halts creditors from taking certain actions such as:

- Starting court proceedings

- Continuing court proceedings

- Instigating foreclosure

- Disconnecting utilities

- Wage garnishments

- Creating, perfecting, or enforcing a lien

- Attempting to repossess collateral

- Evictions

- Calling or contacting the debtor in any way

If creditors continue to take action or harass you after an automatic stay is in place, you are legally able to sue them. Creditors can petition the court to lift the automatic stay if they have sufficient grounds. For instance, if a property’s value will suffer during the automatic stay, the mortgage company can petition to continue being paid during the bankruptcy.

Which Debts Are Not Covered By The Bankruptcy Automatic Stay?

While the automatic stay can provide significant relief from creditors and debt collection actions, there are some debts that are exempt. You will still be expected to make payments on these debts during your bankruptcy. The exempt debts include:

- Child support

- Alimony payments

- Debt due to criminal proceedings

- Tax refunds can be seized due to tax debt

Limitations Of The Automatic Stay In Bankruptcy Cases

An automatic stay in bankruptcy can be powerful, but it does not impact everything. There are still some situations that will remain active such as criminal proceedings. You can be sentenced and assigned fines even during bankruptcy and you will be expected to pay those fines.

There are some IRS and tax-related proceedings that will still be in effect as well. You can be audited during bankruptcy, you can be contacted by the IRS about tax deficiencies, and you can still be required to give back your tax return. However, you should contact a bankruptcy lawyer if the IRS attempts to levy your bank account, seize assets, or file a lien after your bankruptcy filing as this is not allowed.

How Long Does The Automatic Stay Last?

It’s important to understand how long the automatic stay will last, giving you relief from debt collectors. How long it lasts depends on what chapter of bankruptcy you file for and how many bankruptcy filings you have.

In general, your automatic stay will last as long as your bankruptcy proceedings continue. This means that if your case is dismissed, the automatic stay will be lifted. Because Chapter 7 bankruptcy is a shorter process than Chapter 13, the automatic stay will be shorter. Likewise, Chapter 13 bankruptcy can take 3-5 years as will your automatic stay.

The exceptions to this are if you file more than one bankruptcy within a year. If you file for a second bankruptcy within a year, the automatic stay will be limited to 30 days for that bankruptcy. If you file more than 2 in a year, you will not be granted any automatic stay for the third and consecutive bankruptcies.

Penalties For Violating The Bankruptcy Automatic Stay

Creditors that violate automatic stays are given serious penalties. If a creditor knowingly or negligently violates the stay, they could be subject to a lawsuit from the debtor. The debtor can claim damages like emotional distress, lost wages, and out-of-pocket costs in the lawsuit.

Punitive damages can also be assigned by the court if a creditor is found willfully ignoring the automatic stay. If you are being harassed by a creditor and you believe it is against your automatic stay, consult with a bankruptcy attorney who can get started on the next steps to protect your rights and claim damages.

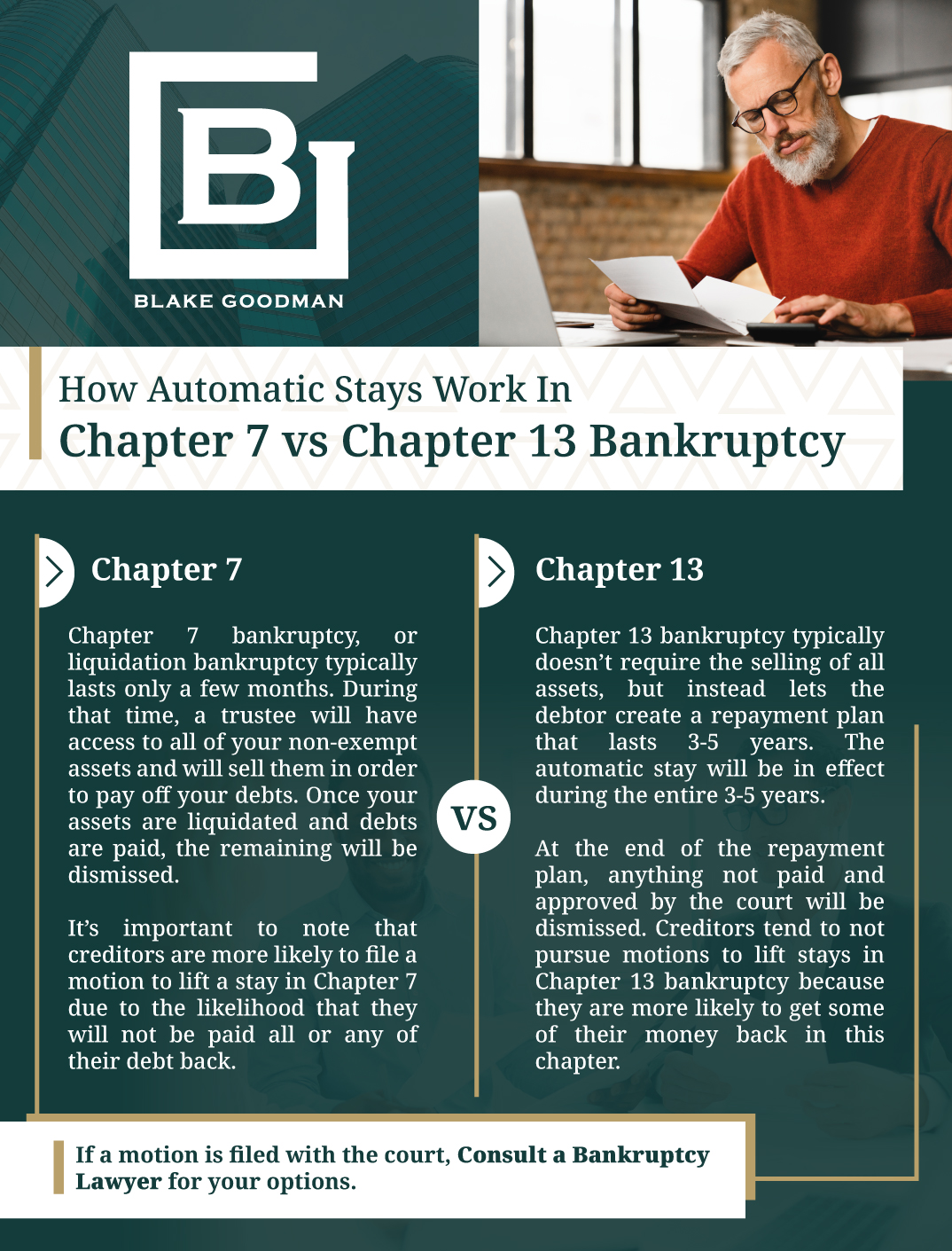

How Automatic Stays Work In Chapter 7 vs Chapter 13 Bankruptcy

Chapter 7

Chapter 7 bankruptcy, or liquidation bankruptcy typically lasts only a few months. During that time, a trustee will have access to all of your non-exempt assets and will sell them in order to pay off your debts. Once your assets are liquidated and debts are paid, the remaining will be dismissed.

Chapter 7 bankruptcy, or liquidation bankruptcy typically lasts only a few months. During that time, a trustee will have access to all of your non-exempt assets and will sell them in order to pay off your debts. Once your assets are liquidated and debts are paid, the remaining will be dismissed.

The automatic stay during Chapter 7 bankruptcy only lasts during the months that the bankruptcy is in process. However, most of your debts will be paid off or dismissed so you should not have creditors after you once your bankruptcy is complete.

It’s important to note that creditors are more likely to file a motion to lift a stay in Chapter 7 due to the likelihood that they will not be paid all or any of their debt back. If a motion is filed with the court, consult a bankruptcy lawyer for your options.

Chapter 13

Chapter 13 bankruptcy typically doesn’t require the selling of all assets, but instead lets the debtor create a repayment plan that lasts 3-5 years. The automatic stay will be in effect during the entire 3-5 years.

At the end of the repayment plan, anything not paid and approved by the court will be dismissed. Creditors tend to not pursue motions to lift stays in Chapter 13 bankruptcy because they are more likely to get some of their money back in this chapter.

Contact a Honolulu Bankruptcy Lawyer For More Information About Automatic Stay Protections

Are you being contacted by creditors and in danger of losing your home or other assets? Look no further for a trustworthy Honolulu bankruptcy lawyer than our experts at Blake Goodman. With 80 years of combined experience, we offer friendly and compassionate services and we will fight hard to protect your rights.

Make sure your bankruptcy is handled in such a way that affords you the best possible outcome. Contact us today for a consultation.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

220 Imi Kala St. #203BWailuku, HI 96793

Phone: (808) 515-2037

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.